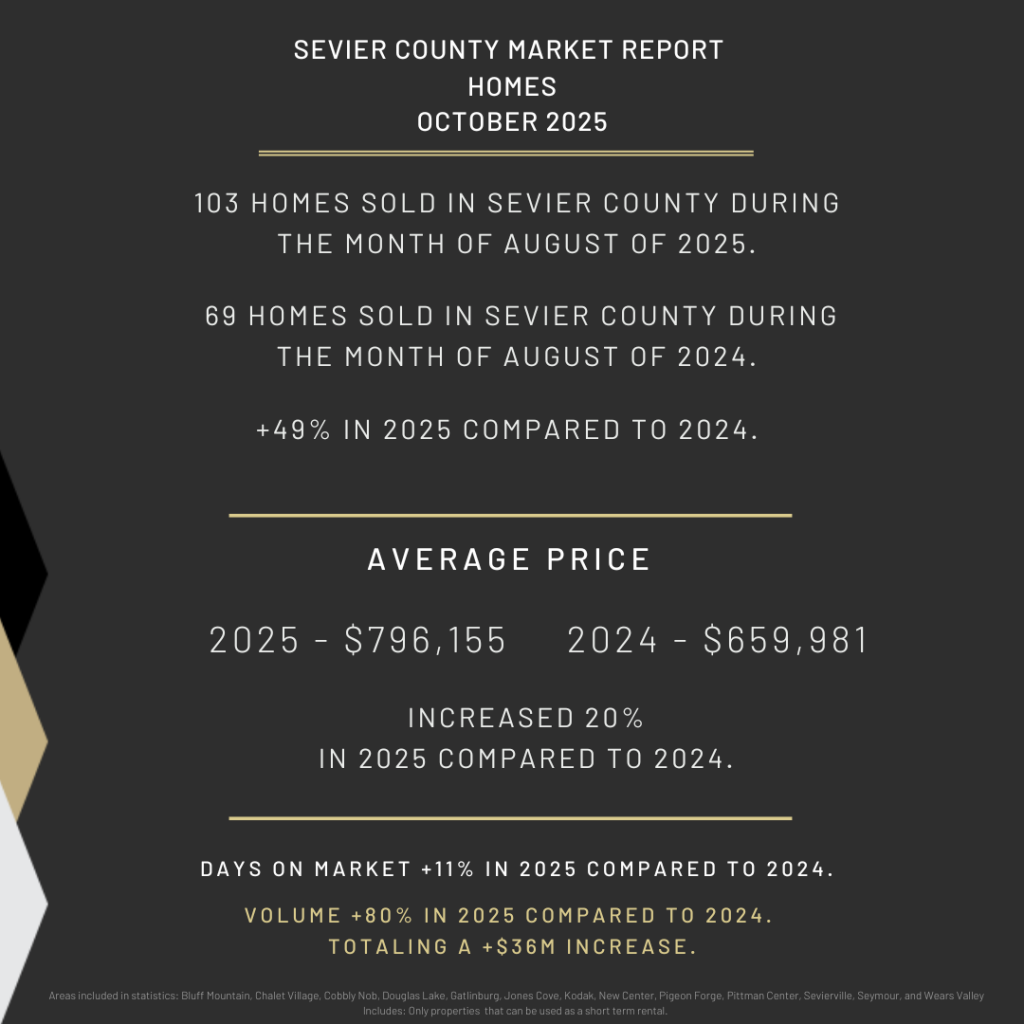

This month resulted in a slower residential pace, with fewer closings, lower average prices, and longer days on market. While land sales were down in count but moved faster than last year.

Residential

Residential sales totaled 51 closings this month in 2026, compared to 59 closings in 2025, which is a 13.56% decline year over year.

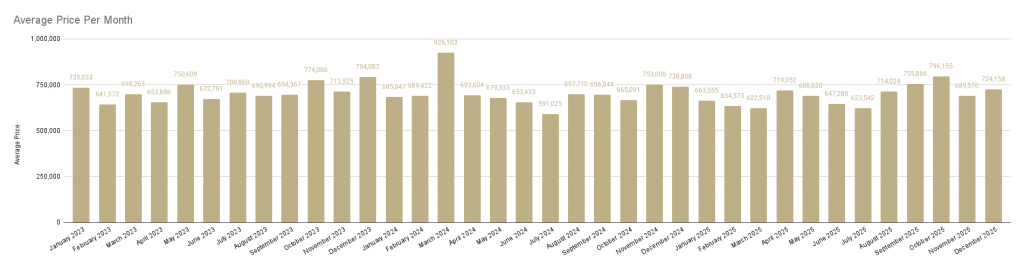

The average residential sale price came in at $555,810, down from $723,114 last year (-23.14%).

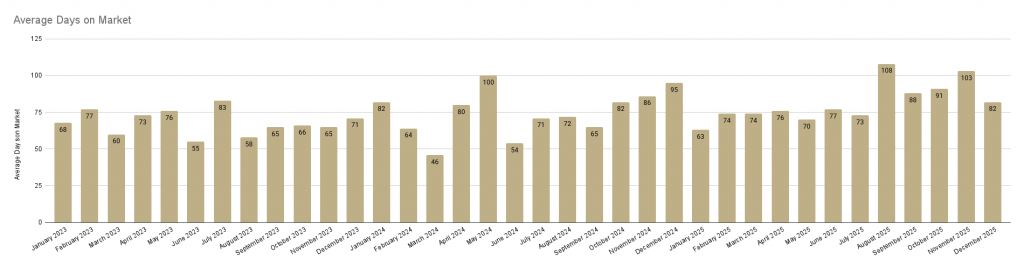

Homes also took notably longer to sell. Average days on market increased to 145 days, compared to 63 days in 2025, which is a 130% jump.

Even with the slower pace, pricing per square foot stayed fairly steady by comparison. Price per square foot averaged $304 this month, down from $328 last year (-7%).

With fewer sales and a lower average price, total residential volume dropped to $28,346,315, down from $42,663,768 in 2025 (-34%, or -$14,317,453).

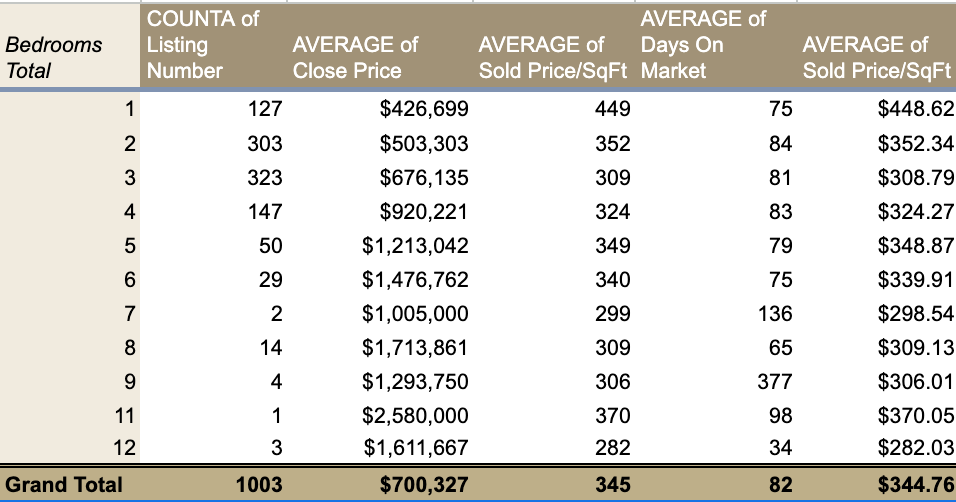

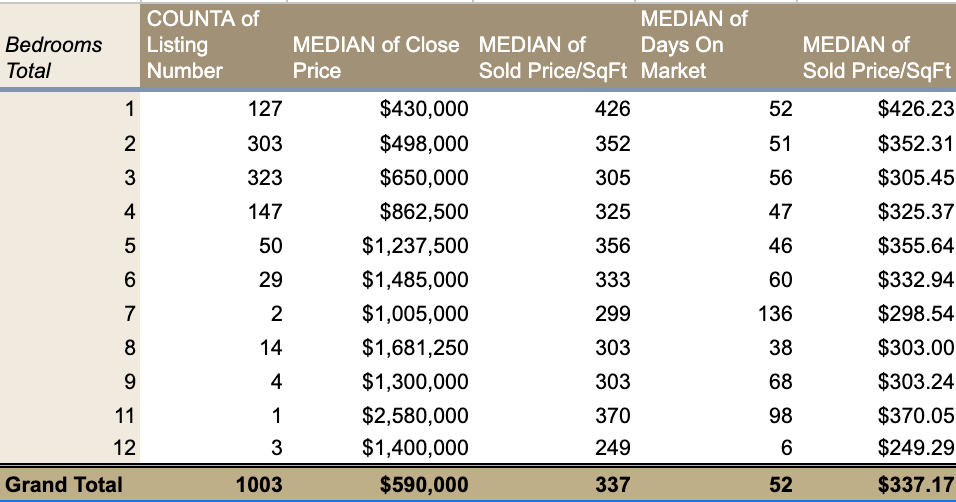

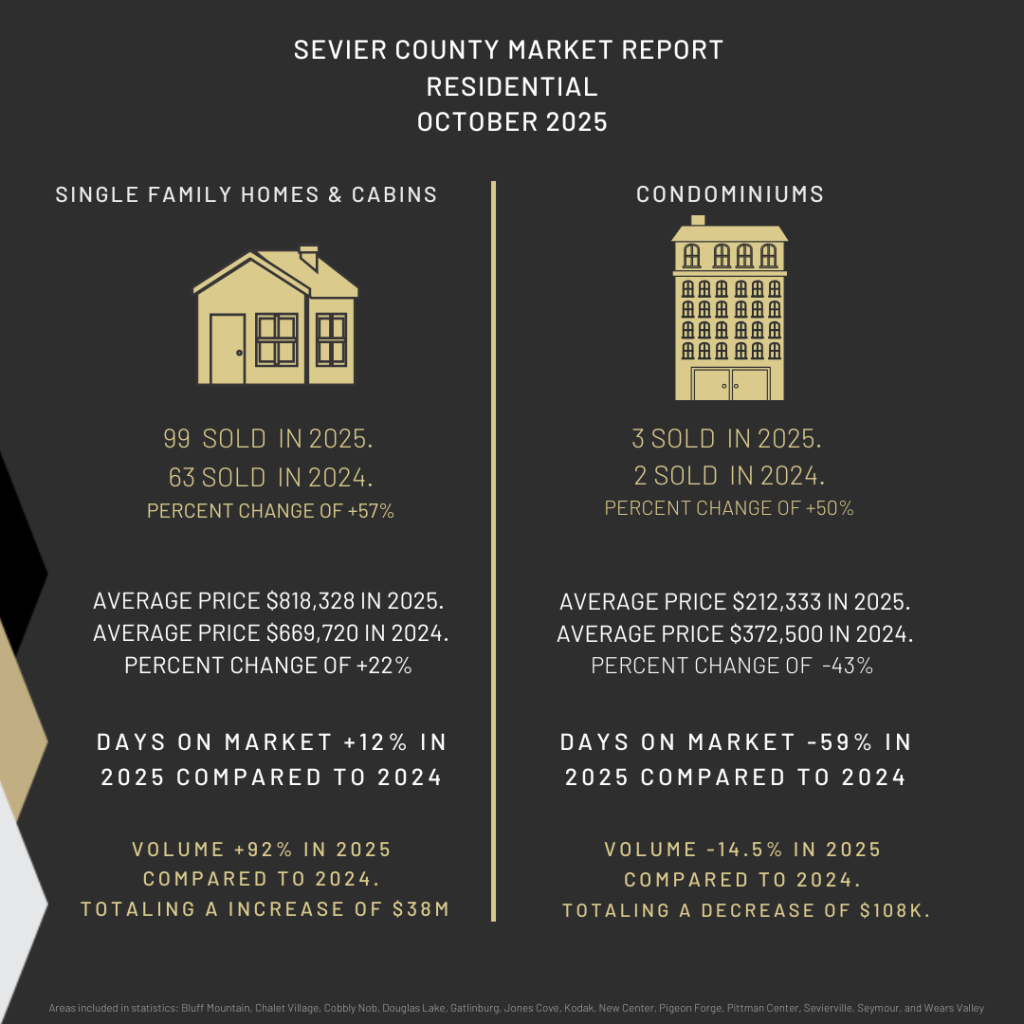

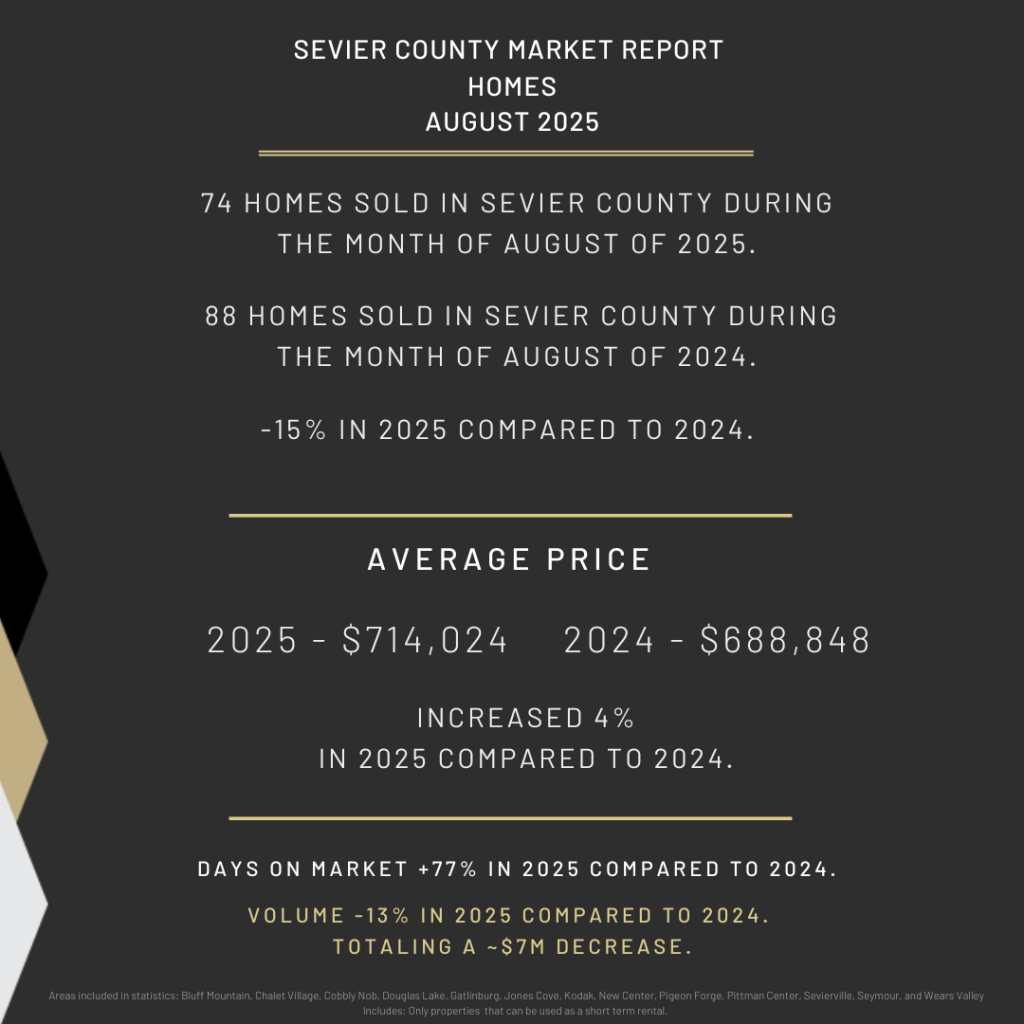

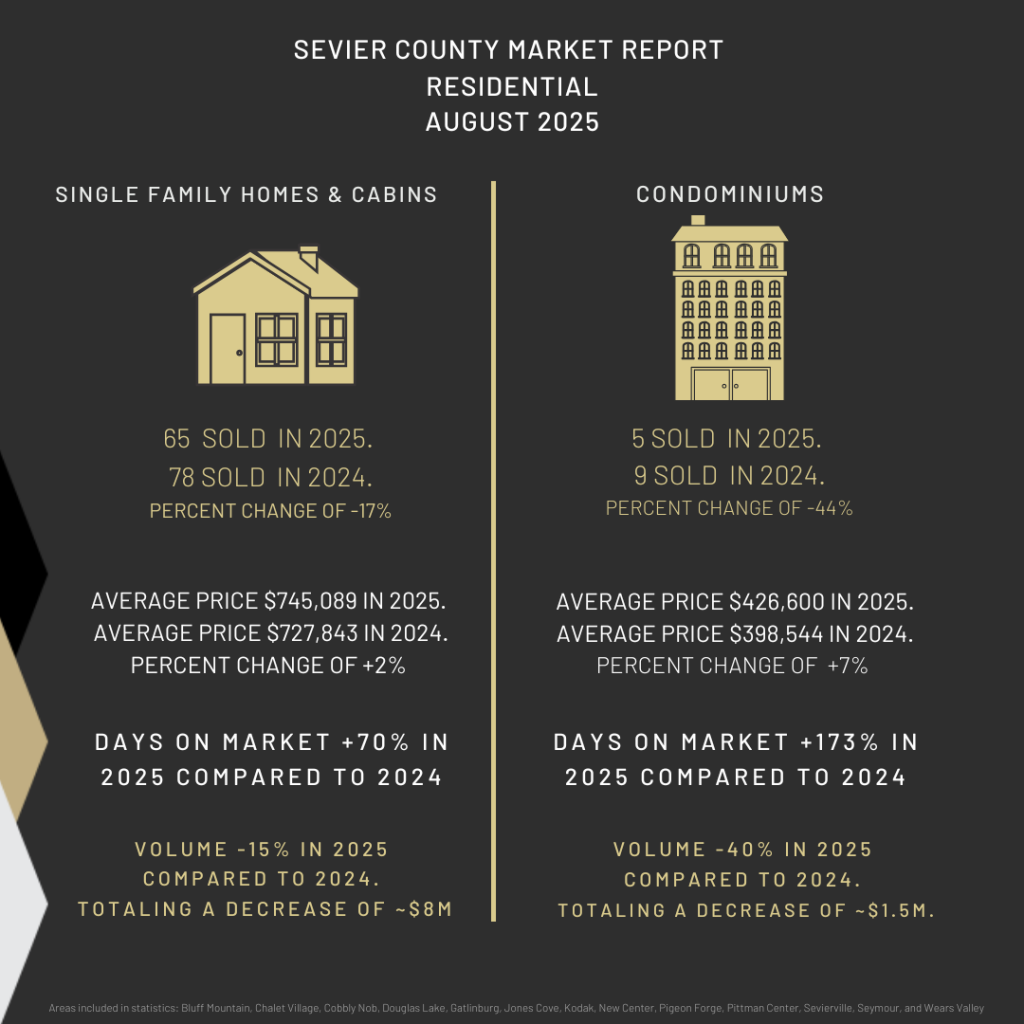

Single Family Homes & Cabins

Single family and cabin sales made up the bulk of residential activity again this month, and this segment is where most of the year-over-year change showed up.

45 single family homes and cabins sold in 2026, compared to 57 in 2025, which is a 21% decrease.

The average sale price in this category was $568,230, down from $739,031 last year (-23.11%).

The pace of the market slowed here as well. Average DOM rose to 148 days, compared to 63 days in 2025 (+135%).

Price per square foot averaged $305, down from $332 last year (-8%).

In total, single family/cabin volume came in at $25,570,365, compared to $42,124,768 last year (-39%, or -$16,554,403).

Condos

Condo numbers were small this month, so the percentage changes look dramatic, but they’re still worth noting.

4 condos sold this month in 2026, compared to 1 condo in 2025.

The average condo sale price was $447,187, up from $280,000 last year (+59.71%), This average was skewed by a higher price sale at the Highlands of the Smokies and a singular sale last year.

Condos also took a bit longer to move. Average DOM increased to 98 days, up from 70 days in 2025 (+40%).

The price per square foot rose to $358, compared to $233 last year (+54%).

With multiple closings this month, total condo volume came in at $1,788,750, compared to $280,000 in 2025 (+538.84%, or +$1,508,750).

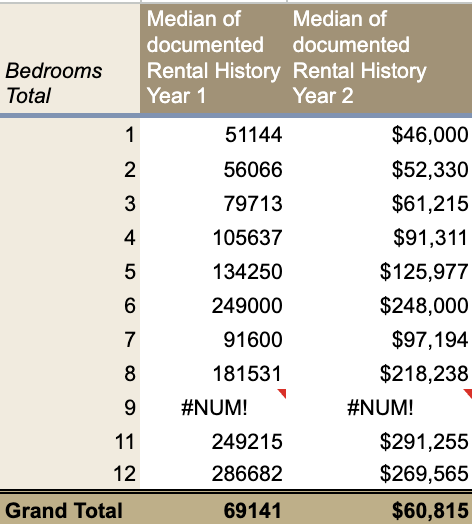

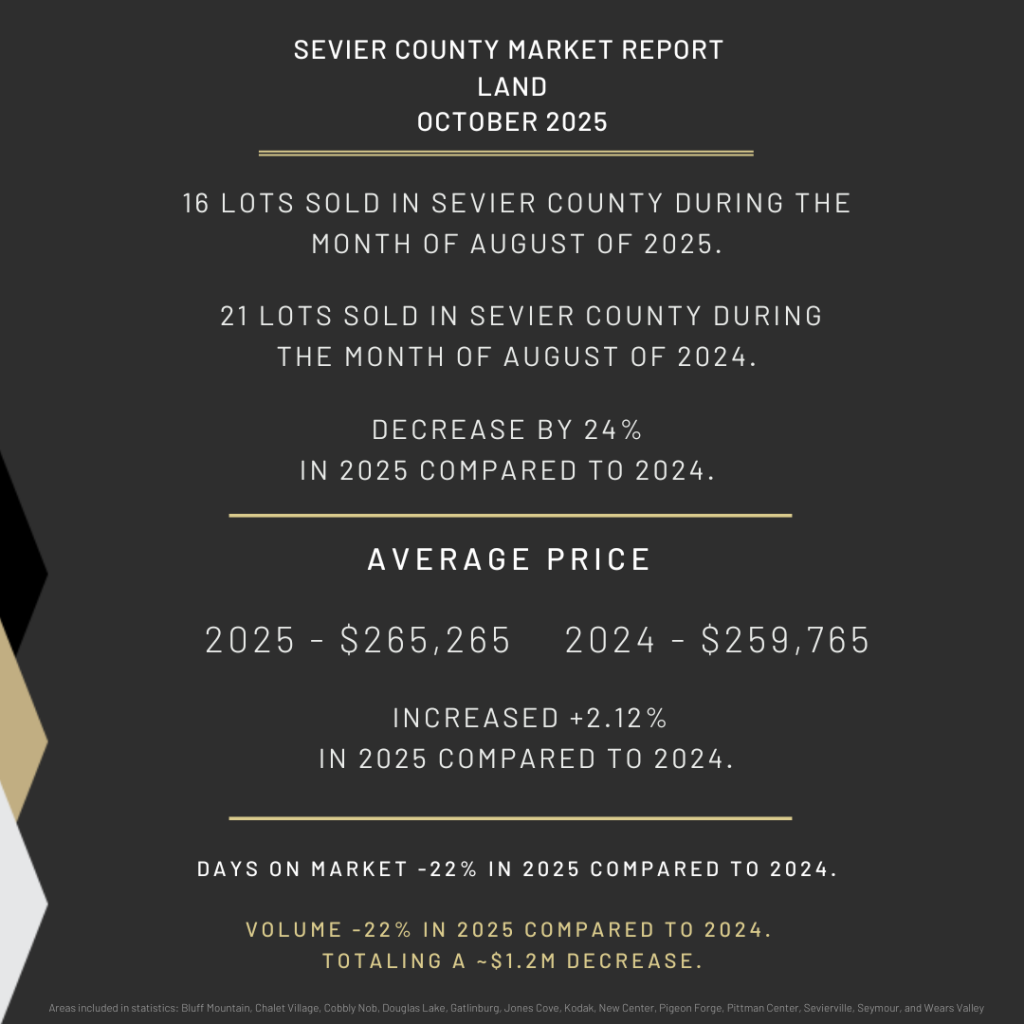

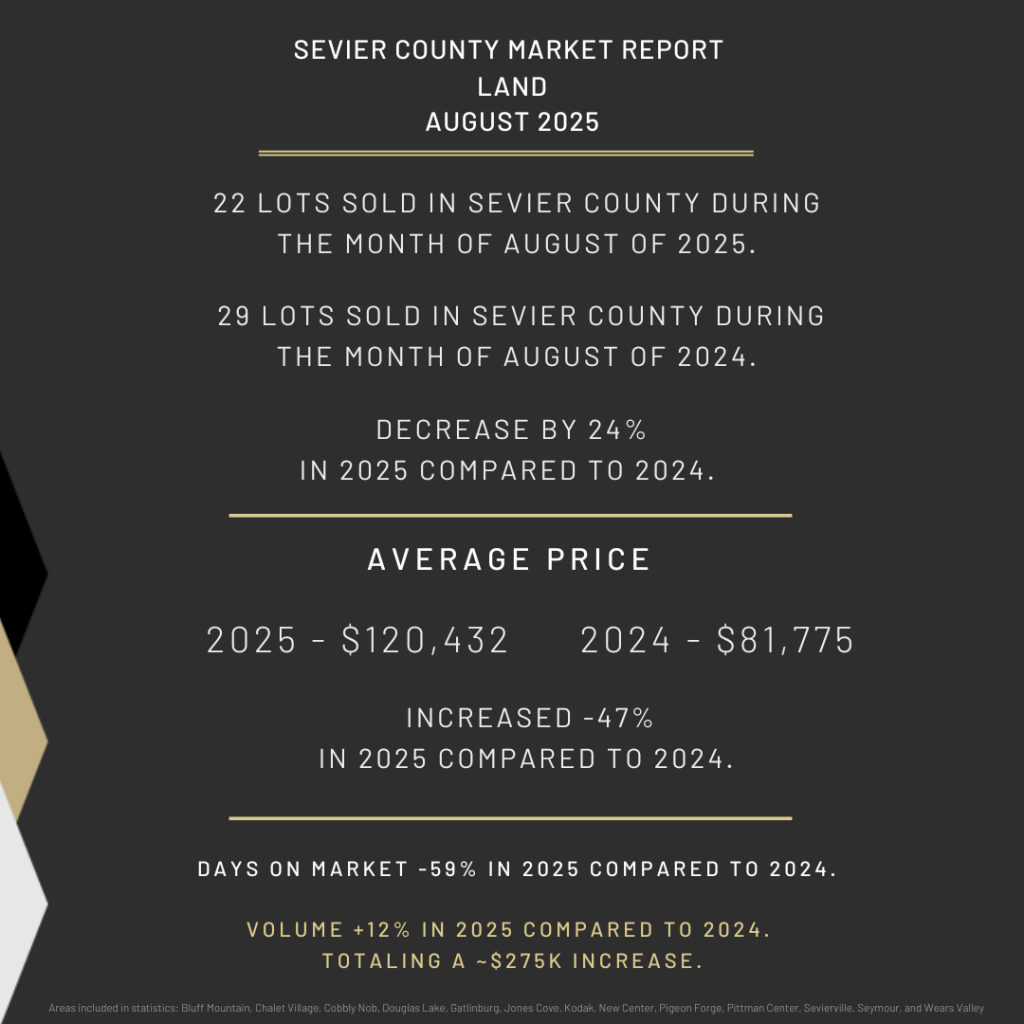

Land

Land activity pulled back significantly this month compared to last year.

12 land lots sold in 2026, down from 27 in 2025, which is a 56% decrease.

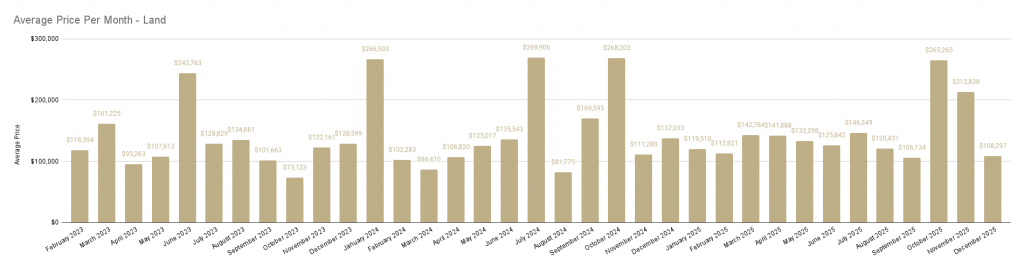

Even with fewer sales, the average land price increased to $136,741, up from $122,237 last year (+11.87%).

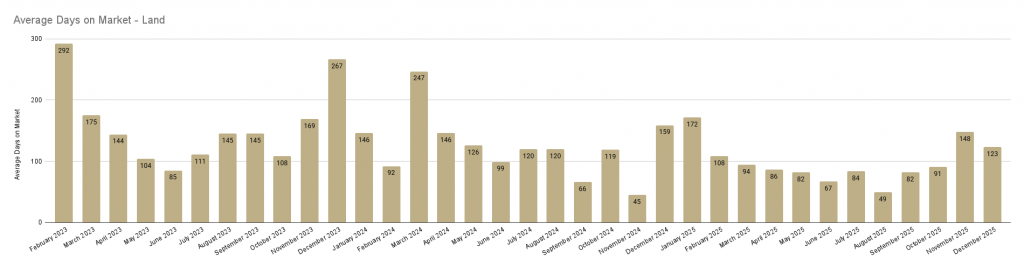

One of the more notable shifts was time to sell. Land DOM improved to 85 days, down from 160 days in 2025 (-47%).

With fewer closings overall, total land volume landed at $1,640,900, compared to $3,300,400 last year (-50%, or -$1,659,500).

The Takeaway This Month

This month’s data reflects a market that is moving slower on the residential side, especially in the single family/cabin segment, with higher days on market and lower overall volume than the same month last year.

At the same time, land sales were down in count and total volume, but the lots that did sell moved faster and at a higher average price.

If you’re trying to decide whether to list, buy, or invest, especially if short-term rental performance is part of your plan, the numbers matter, but so does the property type and the strategy.

We’d love to help you interpret what this month’s data means for you. Contact us today!