July’s market delivered a mixed bag – steady residential sales, a small lift in condo activity, and another cooling month for land.

On the surface, not much has changed, but for short-term rental (STR) investors, there are some signals about where there might be some opportunities.

Residential Market: Stable Demand, Strategic Pricing Needed Stats:

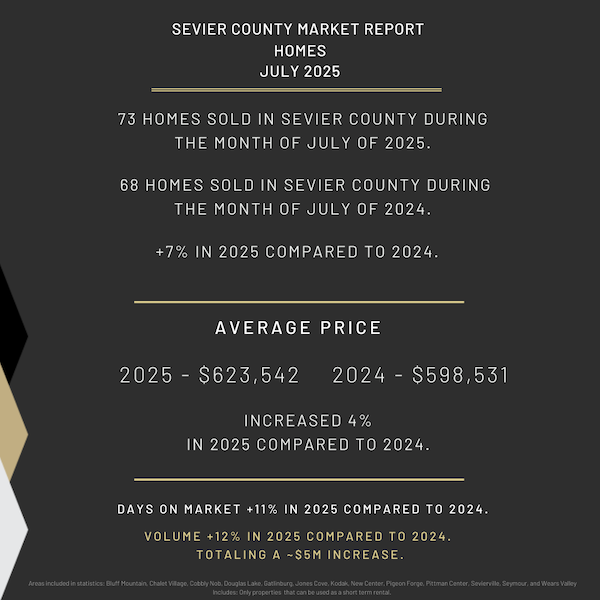

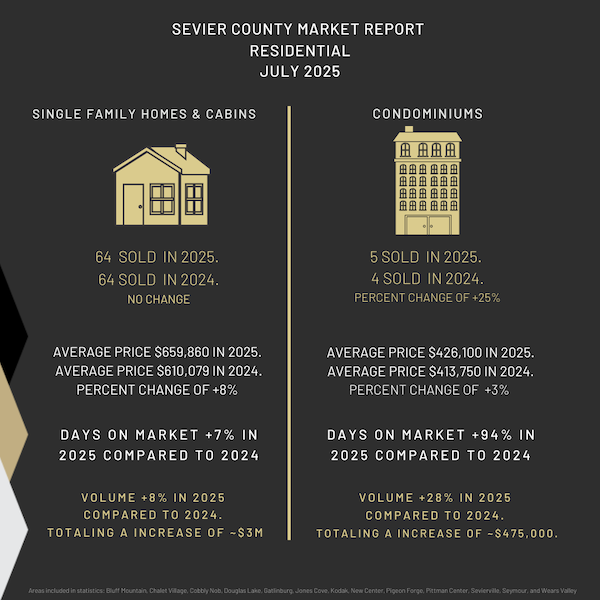

In July, there were 64 single-family home closings, the same as last year.

The average price rose 8.16% to $659,860, while the average price per square foot held steady at $350.

Homes spent an average of 73 days on the market, a 7% increase, and total sales volume climbed 8% to $42.23 million.

Cabins are still selling and for more money than last year even without a bump in the number of closings.

That tells us buyers are paying up for the right property: think great views, guest-friendly layouts, proximity to the Parkway/National Park, and turnkey condition.

The slight rise in DOM means your property can’t just be “good” it has to stand out. In the STR market, that means leading with the features that drive bookings: hot tubs with views, level parking, new furnishings, game rooms, or strong rental history.

Buying: Focus on properties with proven income and easy guest access. A flat $/sq ft means size alone isn’t commanding premiums, features and location are.

Selling: Price right from day one. Overpricing can push you past the 90-day mark, where offers tend to soften.

Single-Family Homes: The Backbone of the STR Market Stats:

July saw 64 closings, unchanged from last year.

The average price increased by 8.16% to $659,860, while the price per square foot remained flat at $350.

Days on market averaged 73, up 7%, and total sales volume reached $42.23 million, an 8% gain.

Flat unit sales with rising prices suggests we’re in a selective, value-driven phase.

Buyers aren’t rushing, but when they find the right fit, they’re paying for it. This is where well-maintained, well-marketed cabins shine.

If you’re buying, target the properties that would pop in a guest search.

If you’re selling, have your rental history and financials ready, today’s STR buyers are running the numbers before they book a showing.

Condos: More Movement, Higher Per-Square-Foot Premiums Stats:

There were 5 condo closings in July, a 25% increase from last year.

The average price rose 2.98% to $426,100, while the average price per square foot jumped 16% to $354.

Days on market nearly doubled to 68, up 94%, and total sales volume climbed 28.7% to $2.13 million.

Condos are commanding significantly higher $/sq ft than a year ago, showing demand for low-maintenance, lower-price-point STR options.

But DOM almost doubled meaning buyers are taking their time to compare.

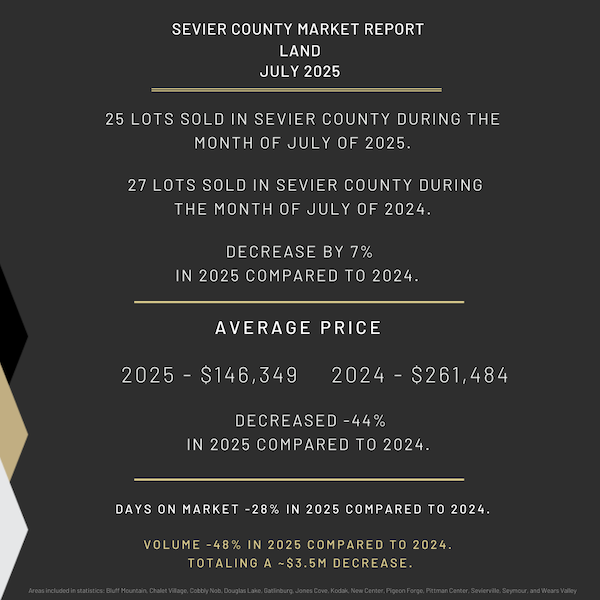

Land/Lots: Prices Down, Speed Up Stats:

July saw 25 land and lot closings, down 7% from last year.

The average price fell 44% to $146,349, while days on market dropped 28% to 84.

Total sales volume declined 48% to $3.66 million.

The land market has cooled significantly in both volume and price, but the shorter DOM suggests that desirable parcels are still moving quickly.

That means the right lot (utilities, driveway grade, septic approval) is getting snapped up, while speculative or harder-to-build lots sit.

Buying: Now’s the time to negotiate. Prices are down, and sellers are motivated. Just make sure you understand the full cost to build including infrastructure before you buy.

Selling: Remove unknowns. Provide any additional details you have about your property to increase your listing presentation.

Bottom Line for STR Investors

We’re not in a runaway market anymore, but we’re also not in a slump. July’s market shows that well-positioned residential and condo properties are still commanding strong prices, even as buyers take more time to decide. Meanwhile, the land segment continues to soften, creating opportunities for buyers to secure buildable parcels at lower prices.

Whether you’re adding to your portfolio or positioning a property for sale, success in this market comes down to being strategic, data-driven, and guest-focused.