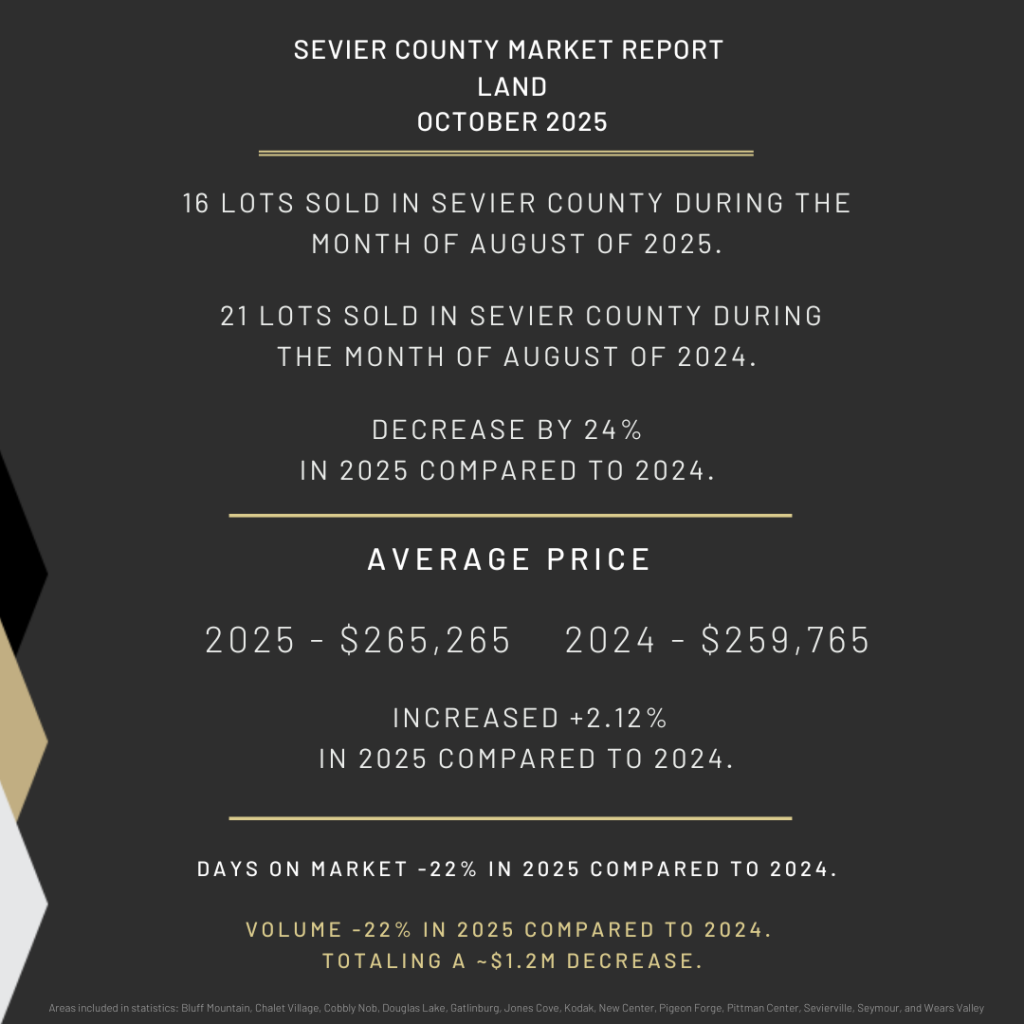

When we step back and look at every closed sale from 2025* a few things become very clear:

- Buyers were active, but selective

- Pricing accuracy mattered more than ever

- Location and property type drove outcomes far more than headlines

Pricing Accuracy & Market Speed

This was the defining theme of 2025. Homes priced correctly from the start behaved very differently than those that missed the mark.

Based on sold listings, properties that closed at or above their original list price overwhelmingly sold faster and with far less friction than those that required price corrections.

- Homes that sold at or above original list typically closed within 30 days

- Properties that sold below original list most often landed in the 120+ day range

- Listings that ultimately sold below their original list price were far more likely to spend extended time on the market. Once pricing had to be adjusted, average days on market increased substantially.

This confirms what we saw anecdotally all year: buyers were willing to act quickly, but only when pricing aligned with perceived value.

What Buyers Actually Bought

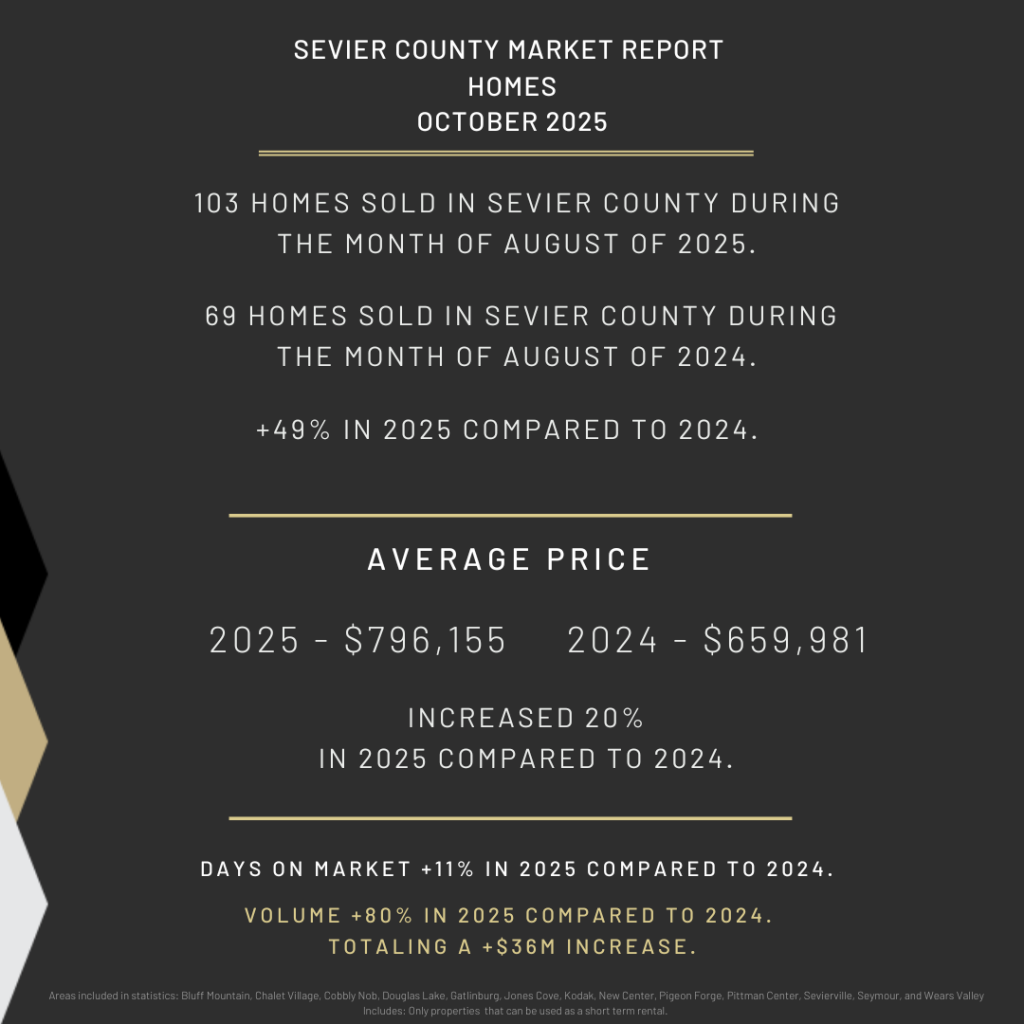

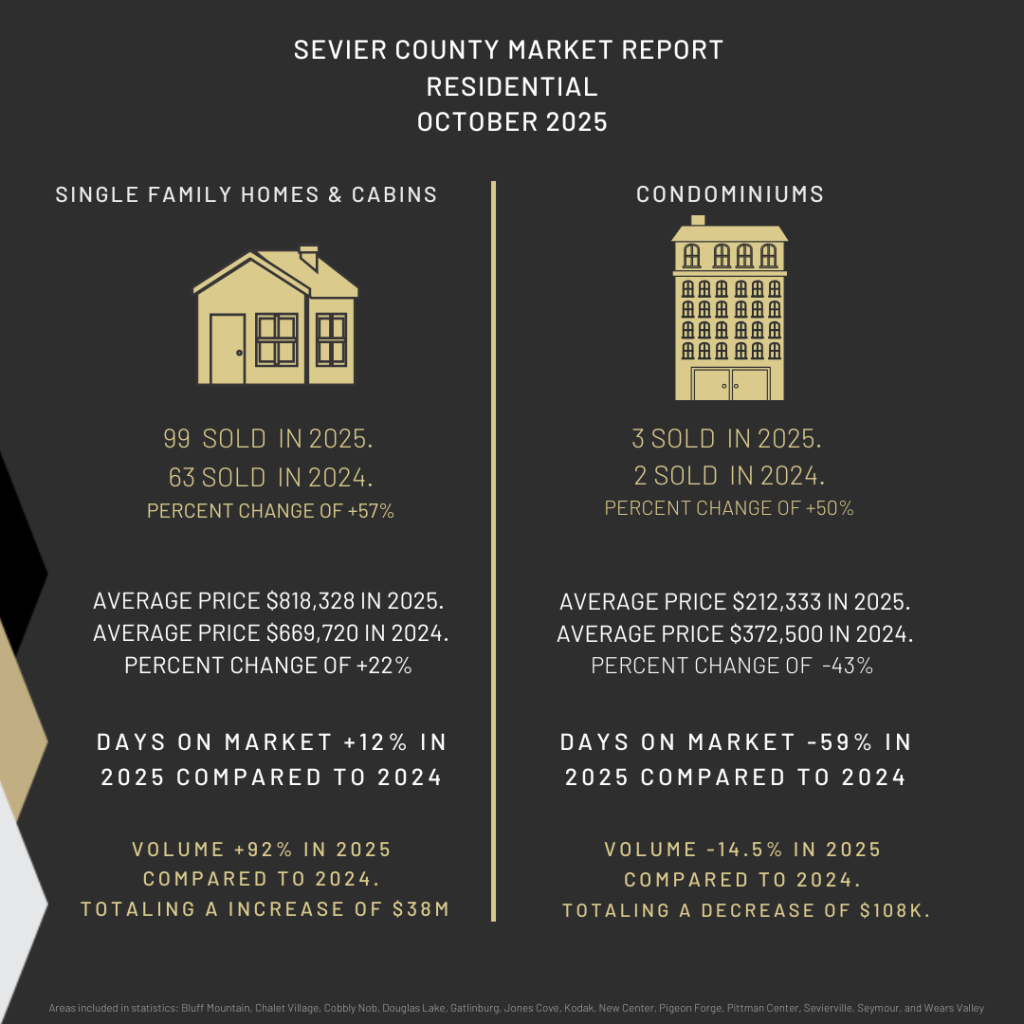

Looking at total sales by property type, one category clearly dominated activity.

- Cabins and single-family homes accounted for the majority of all sales

- These property types also commanded the strongest price per square foot

- Condos and specialty property types represented a much smaller share of total transactions

Location Still Matters, But Not All Locations Perform the Same

When we break sales down by city single family homes show:

- Sevierville led total sales volume, reflecting its mix of STR-friendly areas and accessibility

- Gatlinburg and Pigeon Forge commanded higher price per square foot, but generally took longer to sell

- Days on market were relatively consistent across the top cities, suggesting demand remained stable

Condos Told a Very Different Story

Condos behaved differently from single-family homes in nearly every metric.

- Sales volume was significantly lower

- Average days on market were higher

- Price per square foot was more compressed

- Performance varied sharply by city

In short: condos were more price-sensitive and required sharper positioning to move.

New Construction vs Existing Homes

One of the more interesting takeaways from the data is that new construction did not automatically outperform existing homes.

- New construction did command higher prices and higher price per square foot

- However, days on market were effectively the same

- Existing homes represented the vast majority of closed sales

Buyers weren’t looking for “new” they were looking for value, layout, and location.

Median Data Tells the Real Story

Averages can be skewed in a market like ours. Medians tell a cleaner story.

Looking at median performance by property type:

- Single-family homes and cabins both showed strong median price-per-square-foot performance

- Condos lagged on both pricing and speed

- Days on market remained reasonable for properties aligned with buyer expectations

This reinforces the broader theme of the year: buyers were intentional.

From a full-year perspective, 2025 looks like a healthy normalization year.

Pricing accuracy mattered more than ever.

Turnkey, well-located properties were rewarded.

Buyers took their time, but were still present.

Sellers who adjusted expectations early did well.

This is what a sustainable market looks like after several overheated years, and it sets the stage for informed, confident decisions going forward.

*Areas included in statistics are Bluff Mountain, Chalet Village, Cobbly Nob, Douglas Lake, Gatlinburg, Jones Cove, Kodak, New Center, Pigeon Forge, Pittman Center, Sevierville, Seymour, and Wears Valley. Includes Only properties that can be used as a short term rentals.